The quarter has seen a gradual recovery in equity markets, particularly the S&P 500 achieving record highs set in mid 2000 and late 2007.

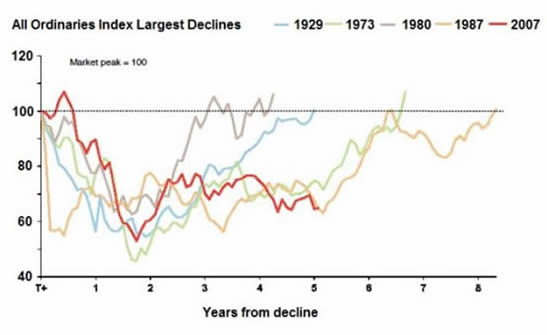

The optimism has been driven by policy action by the major G7 governments to stimulate growth. Below is a recent chart prepared by Fidelity Funds Management Group highlighting the current downturn and recovery. The downturn / recovery is the worst and slowest in Australian history, notably in terms of longevity but also the percentage fall from the peak. The issues that we continue to grapple with are:

- Declining global growth.

- Debt levels in Southern Europe, Spain, etc.

- Weakening data in Australia.

The ASX 200 had a strong quarter closing at 4,387. This was an increase of 7.14% over the 3 month period. News in the quarter focused on further quantitative easing in the US, Europe and Japan. On the domestic front the RBA interest rates remained flat over the September quarter but a 0.25% rate cut was passed at the October meeting. There is a high probability of further interest rate cuts in the coming months.

Australian Market

- Australian data is showing weakness which will increase the prospects of further interest rate cuts. RBA cut interest rates from 3.5% to 3.25% at the October meeting. The RBA still has room to move with the current interest rates but will need to tread carefully over the short term.

- Australia remains one of only seven countries that have retained their AAA rating. The other AAA rated countries are Norway, Canada, Sweden, Singapore, Denmark and Switzerland. This provides a good investment opportunity for foreign investors to invest in Australia, who are attracted to the yield available and this is part of the reason for the high Australian dollar.

- The Australian Hybrid market has been growing rapidly with several major corporations issuing debt during the quarter. Among these were Crown, APA, Caltex, Westpac and NAB. Each of these hybrid notes offers an attractive yield from which we have selectively invested. These investments reduce volatility in portfolios and increase yield. I believe this debt market will become bigger over time. The banks are confident of raising funds in the local market.

European Markets

- Spanish bond yields are rising again reflecting growing concerns on their debt position. Adding to this issue are capital deposits withdrawn out of the Spanish banking system and the high unemployment levels. The Germans are again wavering on the bailout for Spanish banks.

- The French budget continues with the austerity program.

China

- The change in leadership in China has created a vacuum in the economy; there will possibly be no real change until 2013 when the incoming group have their feet under the table.

- There is an increasing view that 2014 -15 will be the peak of mining investment with weakness from commodity prices. Iron ore prices have fallen from highs of $US167.60 to lows of $US86.70 in September 2012. Iron ore has gradually moved into surplus which has resulted in a weakening of price. China continues to be a major consumer however there is a shift in its economic focus from infrastructure to the consumer.

- China has strategically slowed the pace of growth so that it is now between 7 – 8 %. This is a big drop from the highs of 12% in mid 2009. The slowing growth in China may cause a slowdown in Australian economic growth.

The quarter has seen an improvement in companies whose share price has been significantly sold down. Overall the announcements and actions of management will place the organisations in stronger positions. A reasonable market will ensure a recovery of their share prices. What we have seen is that governments have used monetary policy as the primary lever to instigate growth but Governments have not been responsible in their spending nor been prepared to commence appropriate infrastructure spending to fast track an economic recovery.

Should you have any queries or want to discuss the above or your portfolios please do not hesitate to contact us.